Do Presidents Affect the Stock Market?

Probably, but it's not obvious how

Campaigning presidents love to take credit for booming economies and assign blame to their opponents for laggard ones.

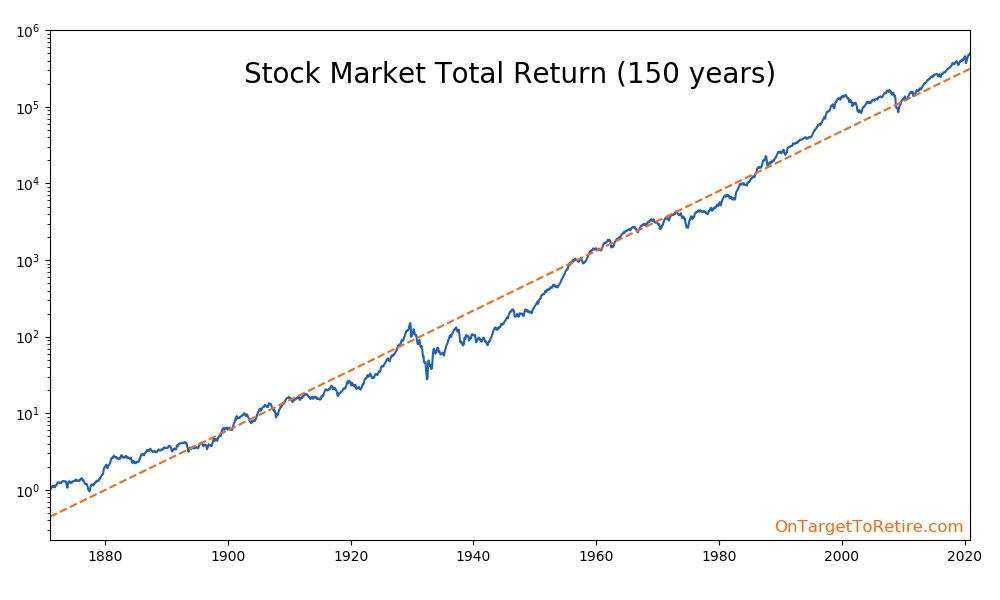

In some ways, this makes sense. Presidents influence decisions on tariffs, immigration, permitting, and war that can all have big effects on the stock market. On the other hand, the stock market seems to closely follow long-term trends and it’s not clear which presidents if any have been successful in deviating from this trend.

I wanted to investigate this more thoroughly so I downloaded the price performance of the total market stock index from 1871-2023 from Robert Schiller’s website here and joined it with a bunch of information on presidents.

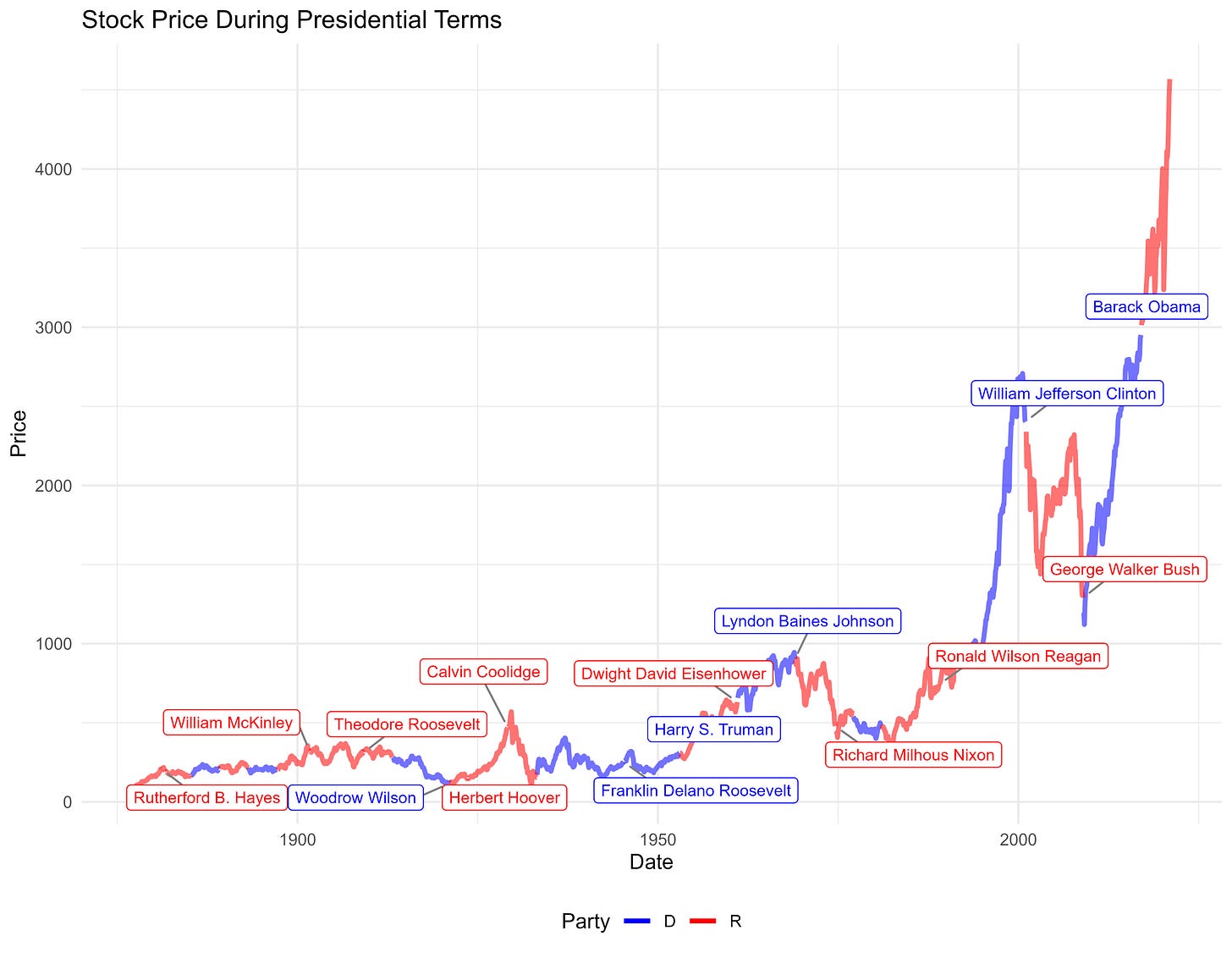

Here’s what the overall index looks from Rutherford B. Hayes to Donald Trump. It’s more volatile than the graph above because it’s just the stock prices, not the returns from holding the stock including dividends.

The presidents are labeled at the end of their terms. All the code and data for the graphs below is available in this github repo in case you want to check or extend this work!

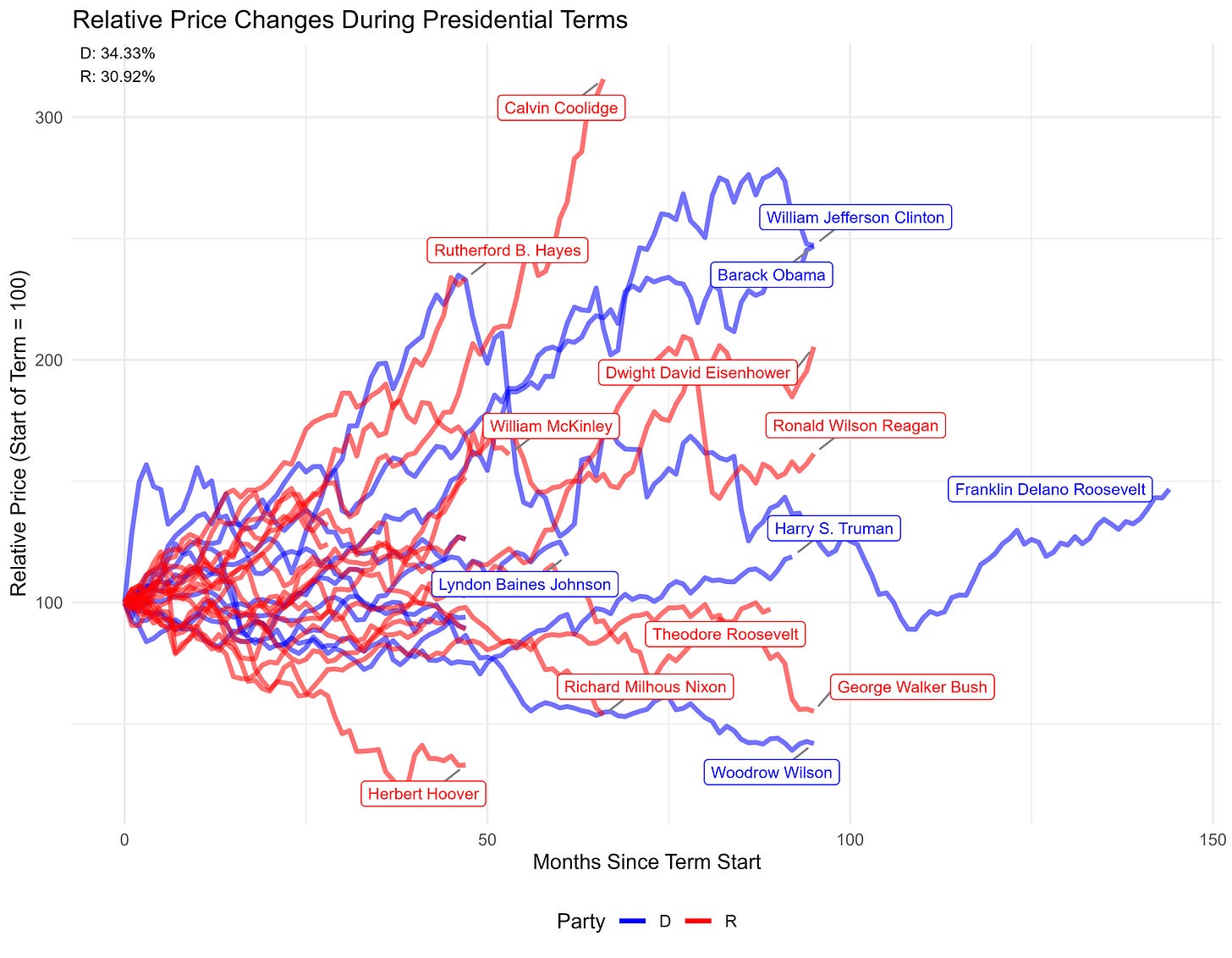

It’s still pretty difficult to see any patterns in this chart. Another way to look at this data is to have the stock market index start at 100 at the beginning of each presidents term and then track how it evolves after that to see which president saw the most (or least) growth in the stock market after taking office.

This is a clearer way to compare presidential performance but perhaps the most notable thing is the lack of clear pattern. Republican presidents have the best and the worst performing stock markets but Democrats have the second best and the second worst. Stock markets perform a bit better under democrat presidents on average (+34% vs +30%) but this advantage is sensitive to outliers and isn’t enough to distinguish from random variation.

The lack of pattern between Republican and Democrat presidents does not prove that presidents have no effect on the stock market. There is plenty of variation between presidents and this variation might well be explained by different choice of policies. If you believe the Median Voter Theorem, you might not be surprised that splitting presidents by party doesn’t split them by economic performance because it also doesn’t split the presidents by policy choices; both parties are appealing to the same median voter.

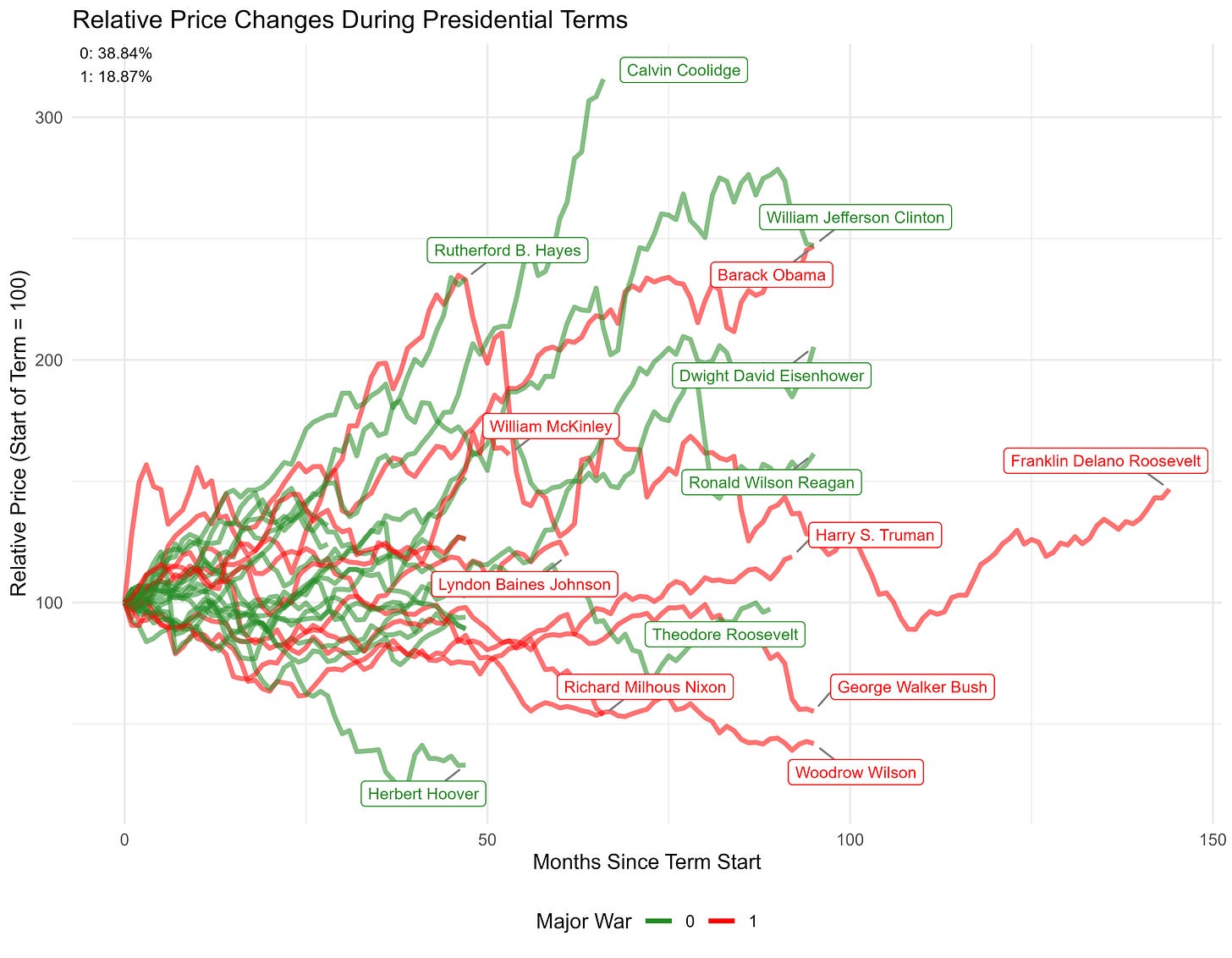

One important policy choice that presidents influence is international war.

Avoiding wars has a clearer positive effect on stock market performance than simply being associated with either party. Of course, confounding variables abound in this analysis and I make no attempt to control for them. It’s still interesting to see which patterns shine through.

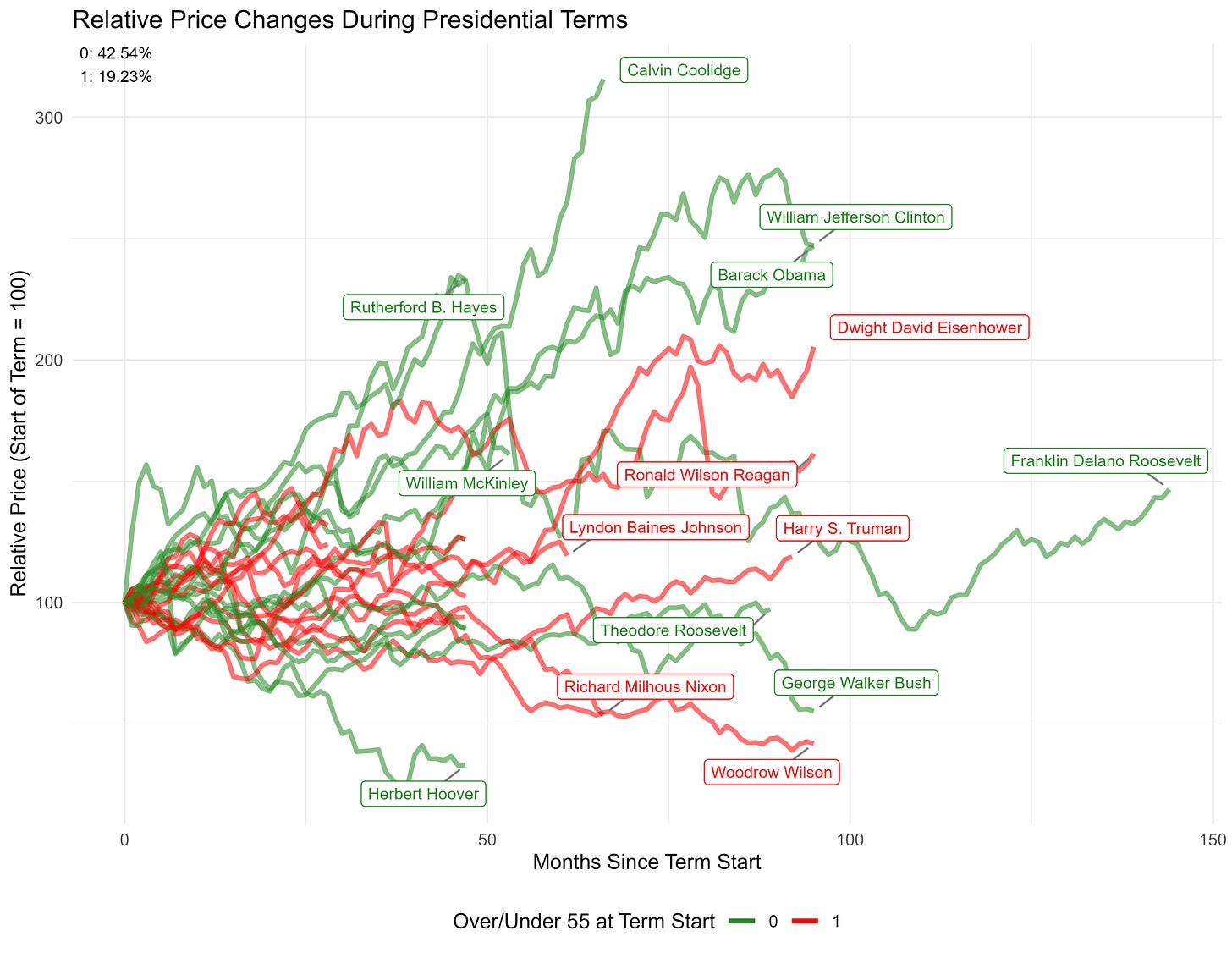

Taller presidents tend to preside over better stock markets.

And younger presidents do better than older ones.

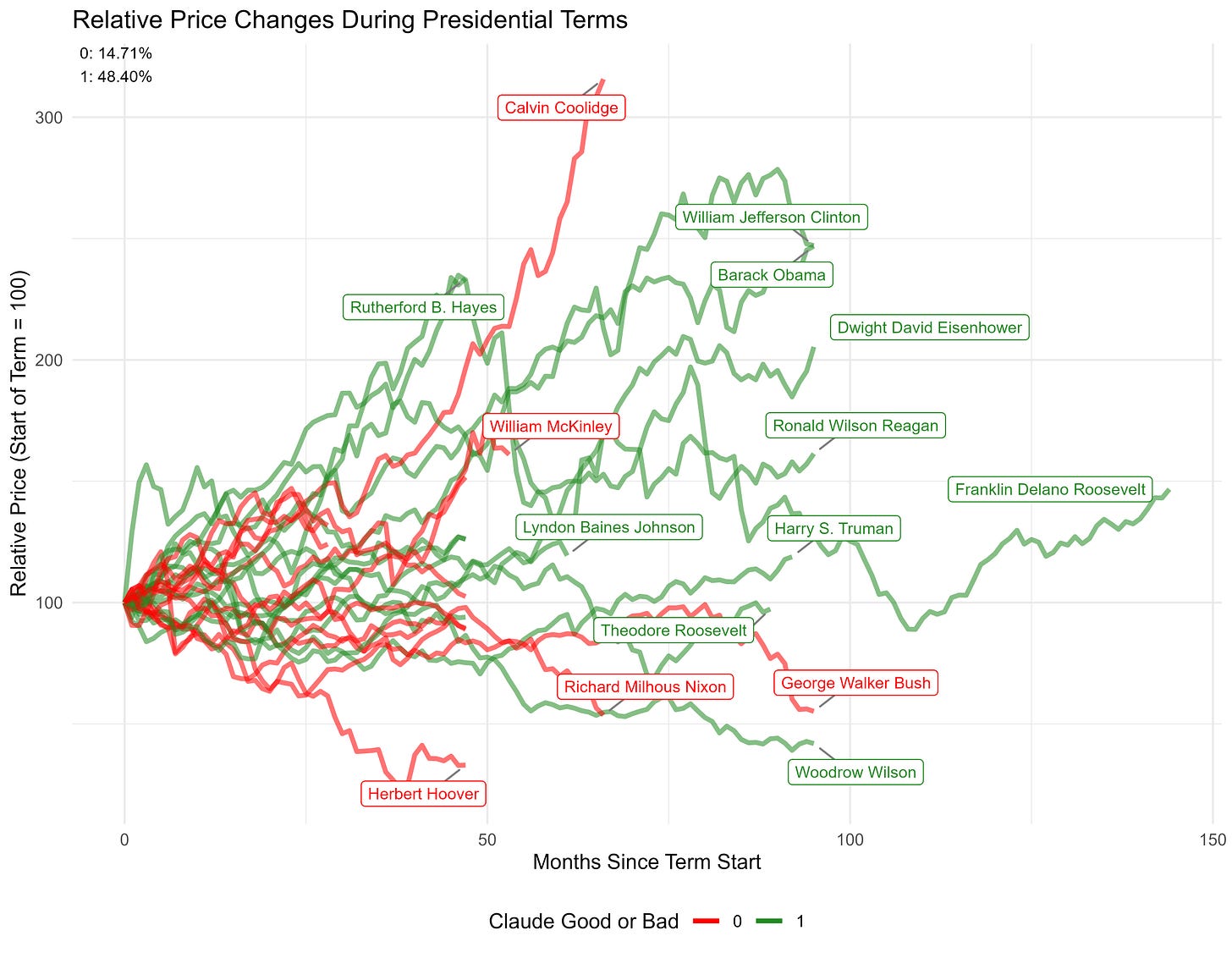

I asked Claude to rank this list of presidents as good or bad and after some cajoling it was willing to. Claude is pretty good at picking good presidents, at least by this metric.

One would need much more detailed analysis to determine the causal impact of a president on the stock market or on economic performance more generally. The non-importance of party affiliation on this performance is interesting and runs counter to campaign narratives.

Next time a candidate claims credit or assigns blame for stock market performance, ask them to explain these graphs!

Addendum: GDP Per Capita

Commenter Centaur Write Satyr suggests graphing “average household purchasing power over time. Is what’s good for Wall Street good for Main Street?”

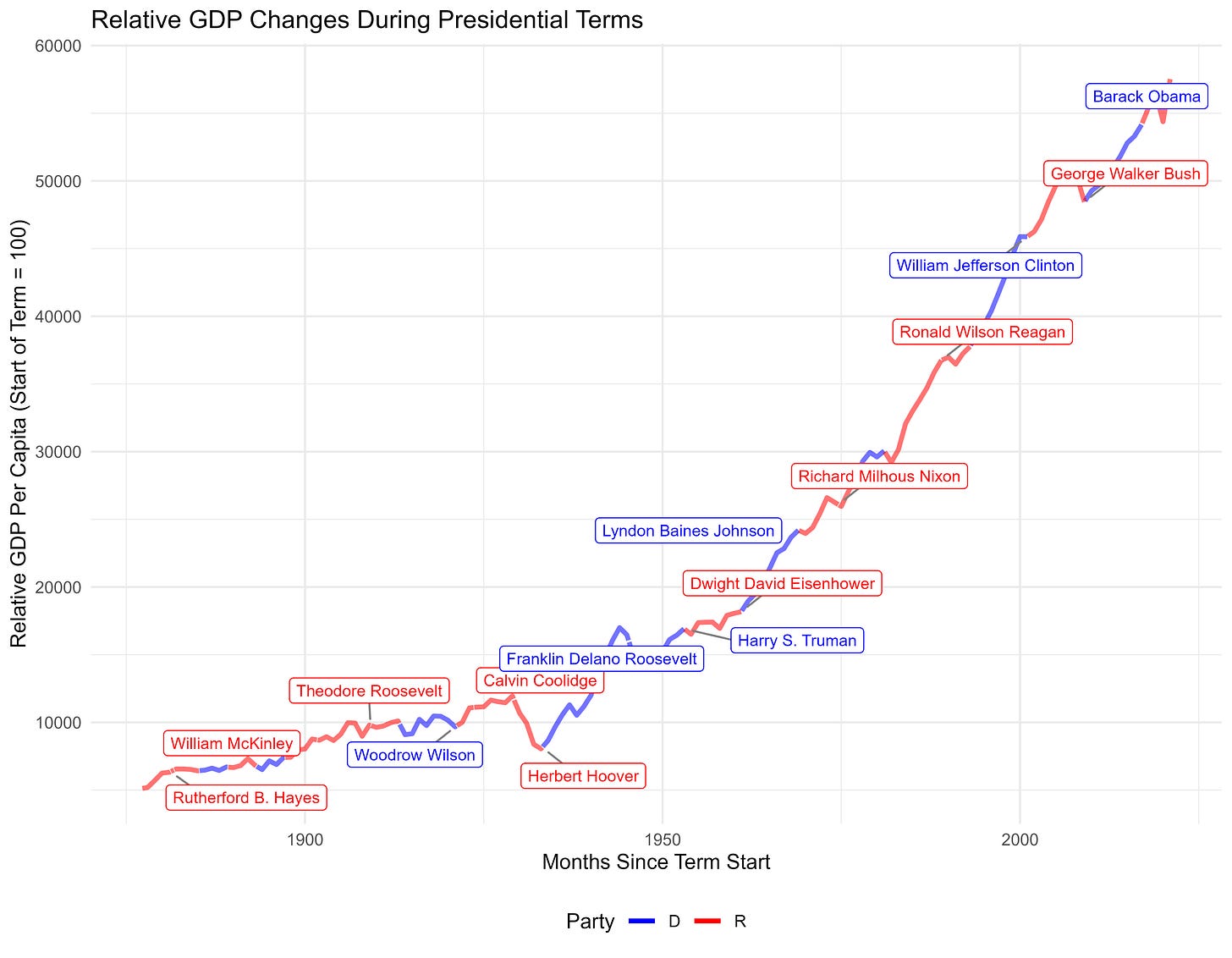

I thought this was a good idea so I downloaded long term GDP per capita data from the Maddison Project here and ran it on the same graphs. Here’s the overall time trend:

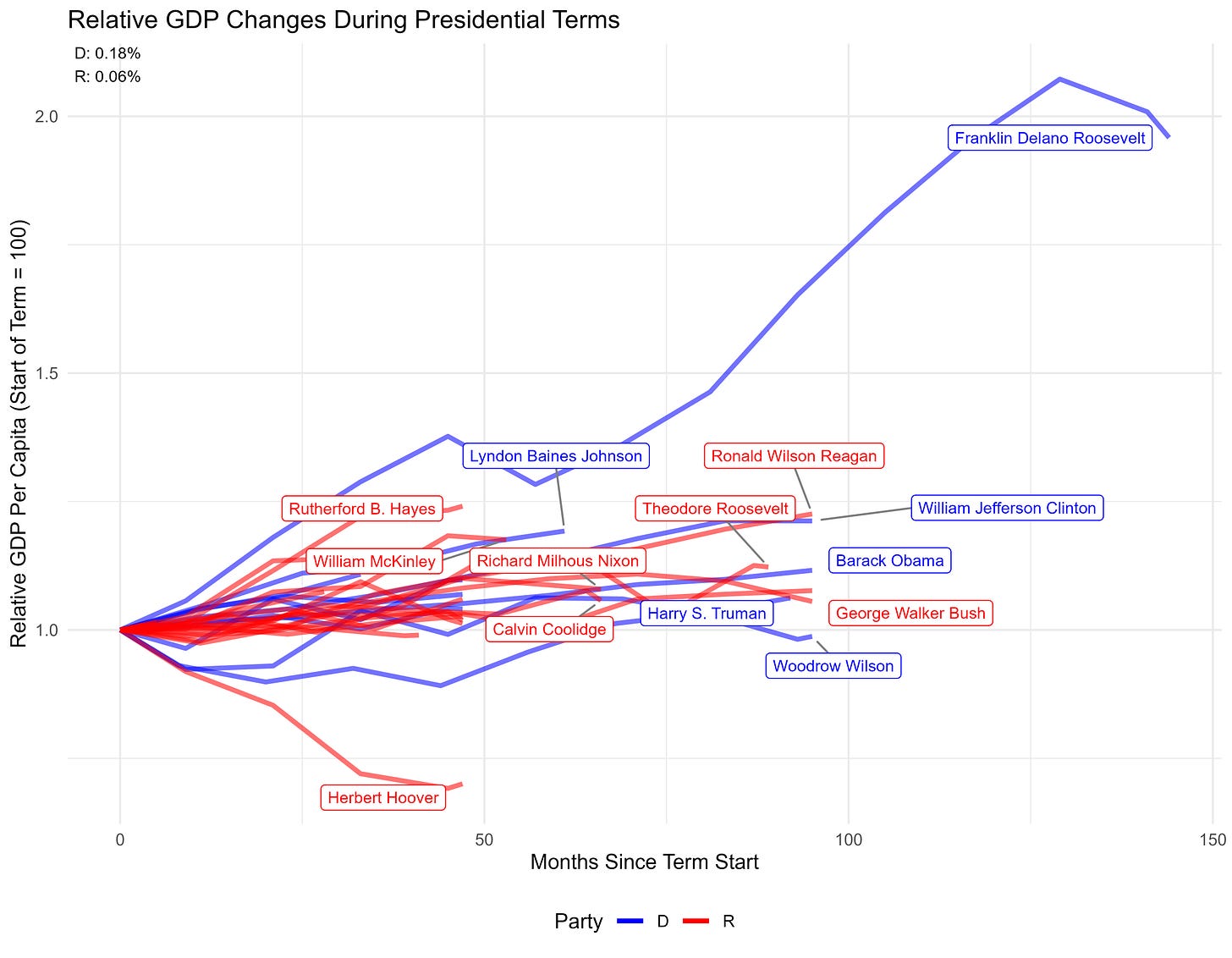

And here’s the relative changes under each president:

FDR has a massive advantage here! He took over in the depths of the great depression, right after Herbert Hoover, so he is helped out a lot by regression to the mean. Again, there are tons of confounding variables here so I wouldn’t read too much into this but it’s still an interesting chart.

Fun! Now do S&P growth versus average household purchasing power over time. Is what’s good for Wall Street good for Main Street?

All of these patterns look pretty random to me... you just don't have that many data points, and the stock market is so different now than it was 100 years ago, you should probably discard any pre-WW2 data.